Simple choice architecture for choosing a winning strategy approach

http://www.adrian-klee.com/wp-content/uploads/2017/11/nigel-tadyanehondo-197128-1024x927.jpg 1024 927 Adrian Klee | Strategy Consulting Adrian Klee | Strategy Consulting http://www.adrian-klee.com/wp-content/uploads/2017/11/nigel-tadyanehondo-197128-1024x927.jpgEven though I have just a couple of years of experience in developing business strategies, I realized that there are too many occasions where strategists rush into a client project, conduct research and benchmarking etc. without properly understanding the “strategic needs” of a client first. For example, I come from an educational context where Design Thinking is commonly used as an approach to solve business problems, which makes me extremely biased towards more classical or other ways of strategic planning. In this article, I want to showcase brilliant research by BCG (Publication: “Your Strategy Needs a Strategy”, M. Reeves, C. Love, and P. Tillmanns, 2012.) that explains how to match the business environment of a company to a specific strategic approach, which is a way of thinking that really helps to choose a winning strategy.

Mental models

Agile Working, Design Thinking or Canvas-approaches were at the core of the most significant intellectual trends of the recent management hype cycle and indeed very successful – when applied under the right circumstances.

Depending on the individual background, each consultancy preaches its own holy grail to winning the strategy game. And of course, it’s easy for the innovation / digital agencies to point the finger to old-school consultancies and industry incumbents by claiming that their planning models are outdated in an ever more digitalized and faster global business environment. They will tell you that if you want to win, you constantly need to adapt and that requires a flexible approach to strategy planning itself. Agile Working, Design Thinking or Canvas-approaches were at the core of the most significant intellectual trends of the recent management hype cycle and indeed very successful – when applied under the right circumstances. However, the notion that the agile approaches are all you need now is simply incorrect, because the world is as always not black and white. We need to stop talking about classic vs. agile and more about how we are going about solving a client’s problem. It’s not about what a good or right strategy is (there are plenty of good ones), but about the best fitting approach to choosing the right strategy in the first place.

Four schools of thought

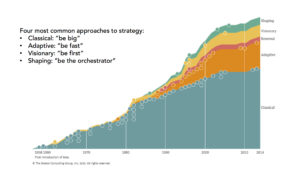

Very simplified, there have been around four thought schools that have generated a variety of individual strategy concepts. According to research by BCG (source), there are four stereotypes of strategy and it makes totally sense:

Visionary (“Be first”): Build an entirely new value proposition by creating a visionary new product or business model. Simplified example: Tesla

Shaping (“Be the orchestrator”): Lead the shaping of a whole segment by collaborating with other companies. Simplified example: Facebook, Google, Lyft

Adaptive (“Be fast”): Whenever it’s difficult to make reliable predictions about a business environment and frequent continuous disruption characterizes the segment, only continuous experimentation and the ability to change oneself will bring a (temporary) advantage. Simplified example: Amazon, Netflix

Classical (“Be big”): Analyze, plan and execute with the goal to achieve superior positioning within the segment, which can be based on company size, differentiation or core capabilities. Simplified example: Philip Morris International Inc.,

You probably familiarize yourself with one school of thought depending on your educational / professional background. Most consultants live and breathe “their” approach to strategy and will always try to implement their strategy tools, even if the client requires completely different solutions. It’s a common mental trap that psychologists call cognitive biases (“living in a bubble.”). Just look at the planning cycle of oil companies vs. the one of a newly founded tech start-up. One size doesn’t fit all. To be sure, this is not about the often-cited ambidexterity of organizations (the challenge of running an existing business vs. inventing its future). This is about the abundance of business environments that any global corporation faces today and the necessity to deploy various (sometimes contradicting) strategic styles at the same time. The clue is to identify the correct state of the business environment, the conditions of the industry, business function, or geographic market and then choose the right approach to strategy, not the other way around. It’s not that there aren’t powerful approaches to strategy, it’s that we lack an unbiased and effective way of choosing the right ones under the right circumstances.

So, which of the four basic strategy approaches are the right ones for your client’s business environments? And how do you classify a business environment?

Choice architecture for picking a winning strategy

Above I described how business strategists can connect their strategic approaches to the business environment, business function or geographical area of their clients. There are four common ways to build a strategy: visionary, shaping, adaptive and classical. All of them have very powerful ways to draft and execute a chosen strategy. In this part I showcase how the unique circumstances of a business determine the right strategy approach.

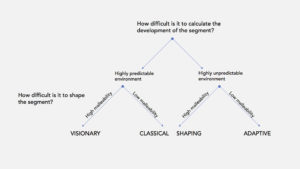

It turns out that characterizing a given business environment is simple:

Predictability (how difficult is it to calculate the development of the segment, i.e. demand, performance, competition, etc.?) x malleability (how difficult is it to shape the segment, alone or with the help of others?)

Visionary: I can predict the future development of the segment it and I have the power to change it. Common concepts: Blue ocean, business-model canvas

Shaping: I can’t calculate the future development of the segment, but I can change it. Common concepts: Platform or network innovation

Adaptive: I can’t predict the future development of the segment nor change it. Common concepts: Design thinking, agile development, hyper-competition, lean start-up

Classical: I can predict the future development of the segment, but I can’t change it. Common concepts: Five forces, core capabilities

Given the two parameters you can match your strategy with the degree of predictability and malleability:

After correctly analyzing the environment (not only for the whole company, but for each of its division/function/geographic market) you can match the corresponding strategy approaches and instill a culture that allows to act on it. This also indicates that most large businesses operate in multiple environments that change quickly over time, so it’s quite possible that a company is forced to deploy a variety of strategy planning approaches.